in this guide

We use your family income estimate to work out how much family assistance you get. Family assistance includes Family Tax Benefit and Child Care Subsidy. Read more about your family income estimate.

If you get Child Care Subsidy, you may also need to update your activity level.

If you or your partner get an income support payment, you’ll need to report changes in your income or earnings separately for that payment. Income support payments may include:

If you get an income support payment from the Department of Veterans’ Affairs you need to include this too. This may include:

- Age Pension

- Income Support Supplement

- Service Pension

- Veteran Payment.

Read more about getting a Department of Veterans’ Affairs (DVA) payment.

The screenshots in this guide are from a computer. The page layout will look different if you’re using a mobile device.

Step 1: get started

Sign into myGov and select Centrelink.

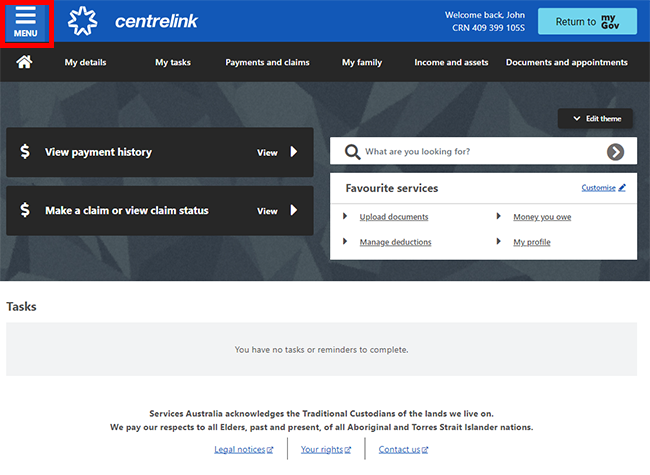

Select MENU from your homepage.

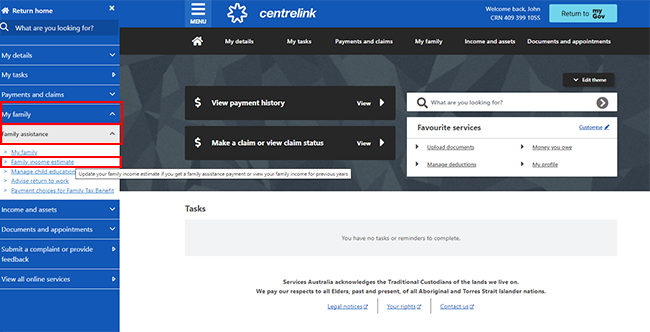

Select My family, then Family assistance and Family income estimate.

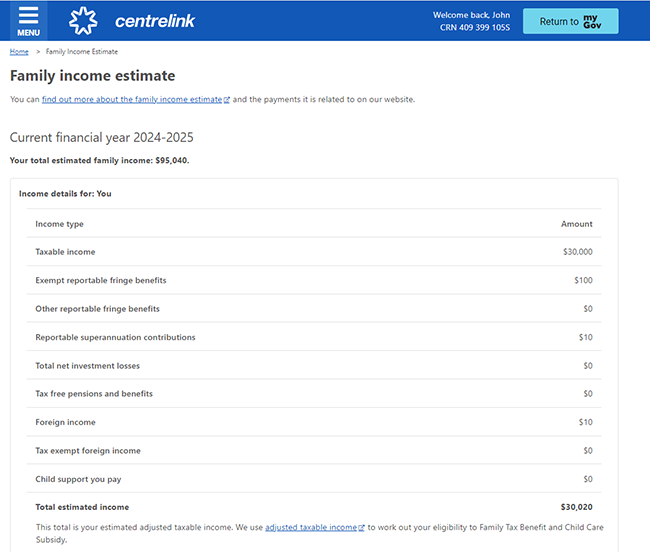

This will take you to a page that shows your family income estimate for the current financial year.

From April to June of each year, you can also provide your family income estimate for the next financial year. Select the tab with the financial year you want to update.

Remember, updating your annual income estimate for family assistance does not update your income for income support payments. You may also need to report changes in your income or earnings separately. You need to do this if you or your partner get an income support payment such as:

Step 2: update your family income estimate

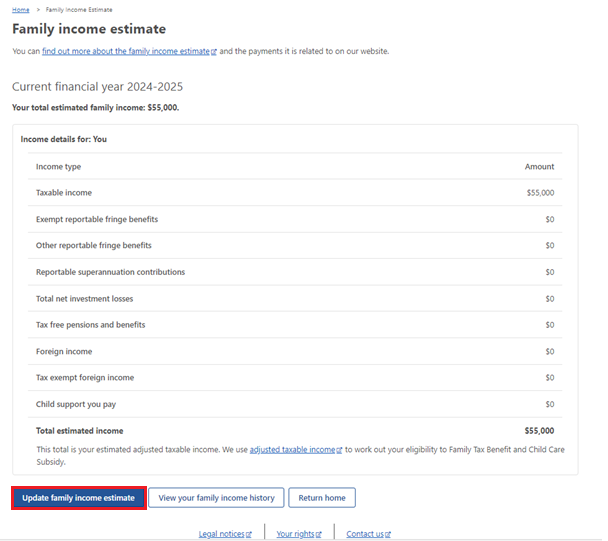

To update your income estimate, move down the page and select Update income estimate.

If you have a partner, you’ll need to update their income estimate as well. Your partner’s income estimate will show below your income estimate.

Make sure you’re aware of what to include in your income estimate. There are some payments you don’t need to include like Family Tax Benefit, Remote Area Allowance, Carer Allowance, Energy Supplement and Rent Assistance.

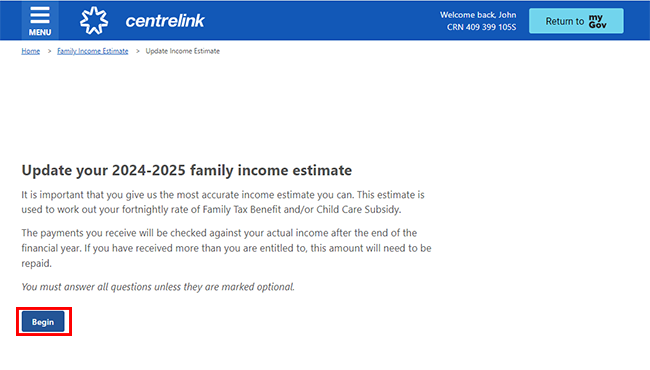

Select Begin after confirming the income year you selected to update.

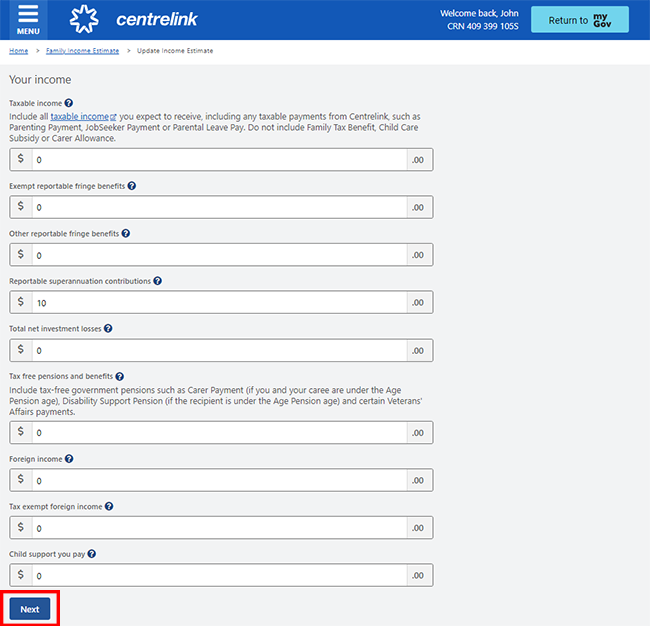

Enter your estimated income amounts into the boxes. If something doesn’t apply to you, leave that box as $0.

Alerts will appear at the top of the page to help you.

When you’ve entered your amounts, select Next.

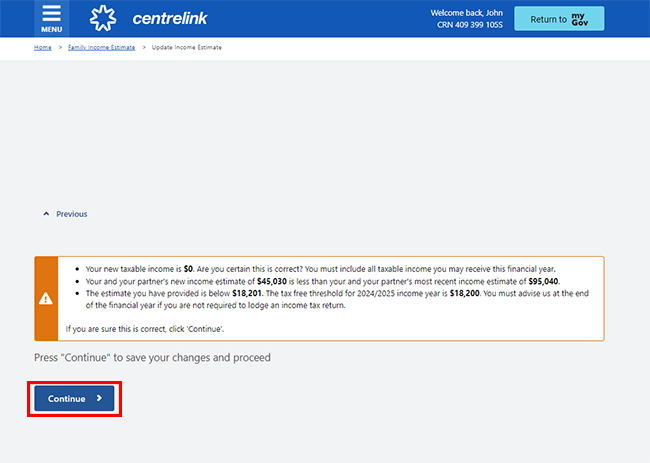

If an amount you’ve entered doesn’t match our records, we’ll need you to tell us more information. A message will appear at the top of the page. It lets you know what you need to do.

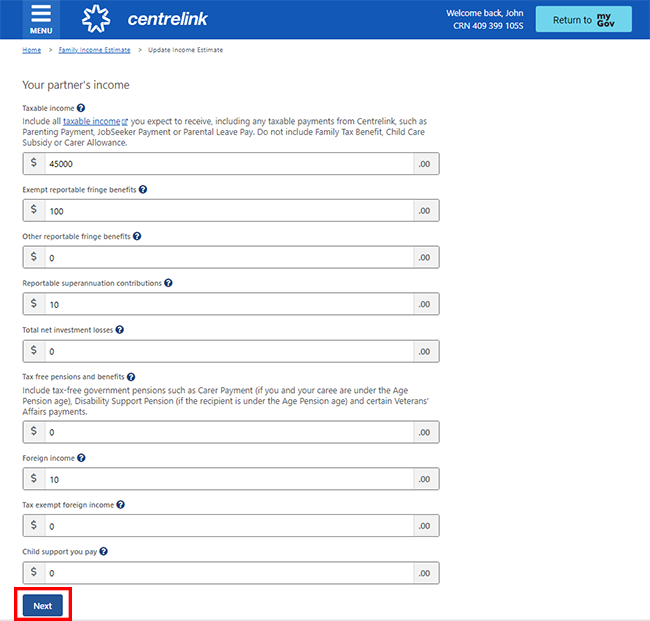

If you have a partner, enter their amounts, then select Next.

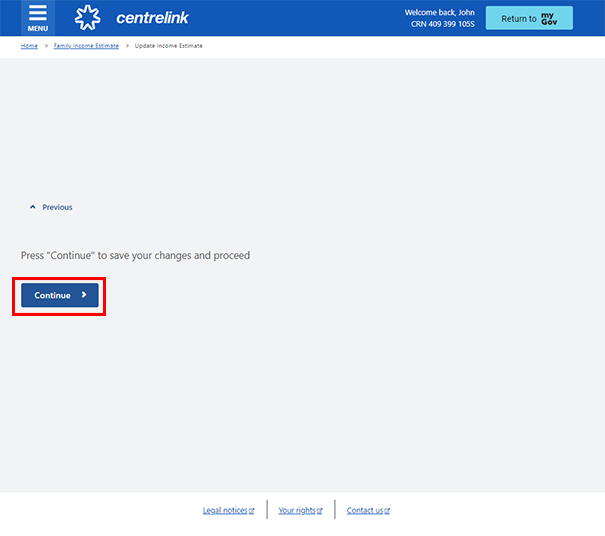

Select Continue to save your changes and proceed.

Review your income estimate update and select Continue to save your changes and proceed.

Step 3: confirm update to family income estimate

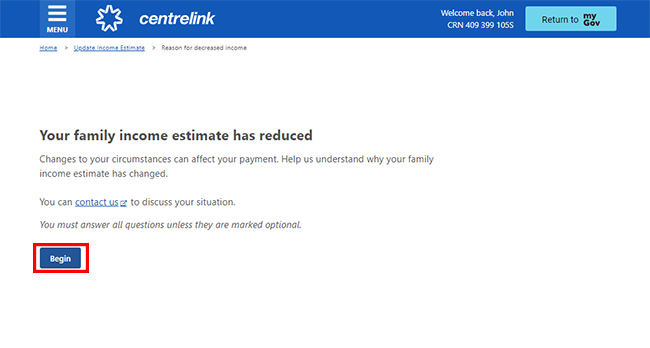

If your income has gone down, you may need to tell us why. Select Begin to continue.

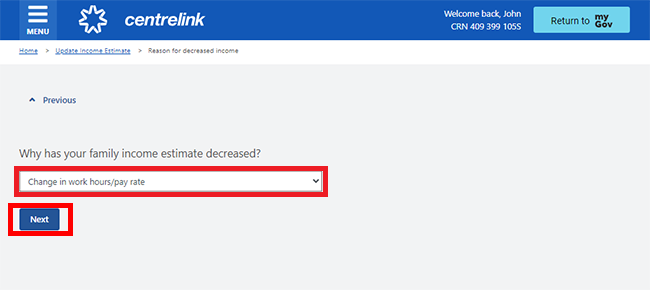

This helps us to verify your estimate is reasonable. You can do this using the dropdown menu, then select Next.

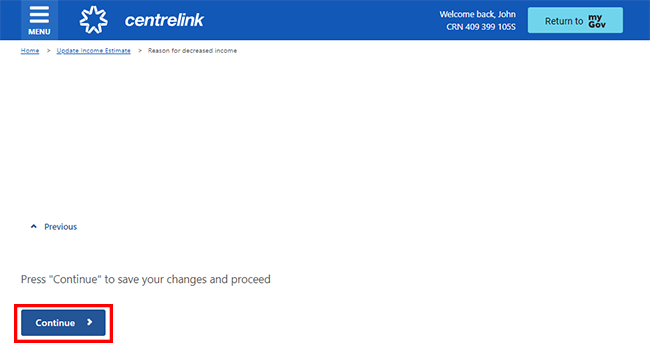

Select Continue to save your changes and proceed.

Select Begin to review the information you’ve given us.

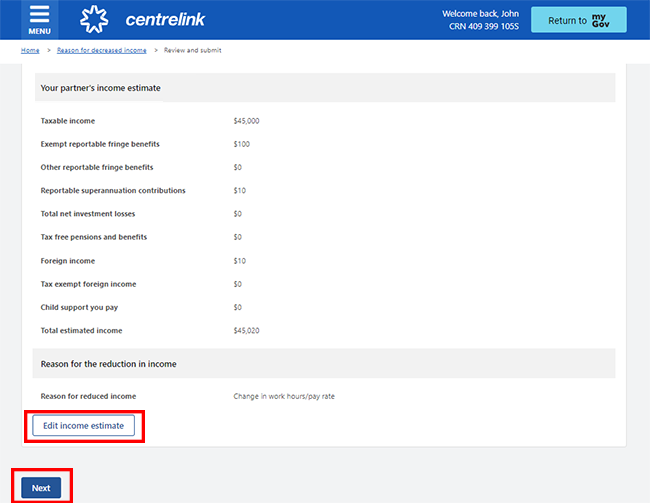

Review each section to check the details are correct. If you need to make changes, select Edit income estimate.

If all the details are correct, select Next.

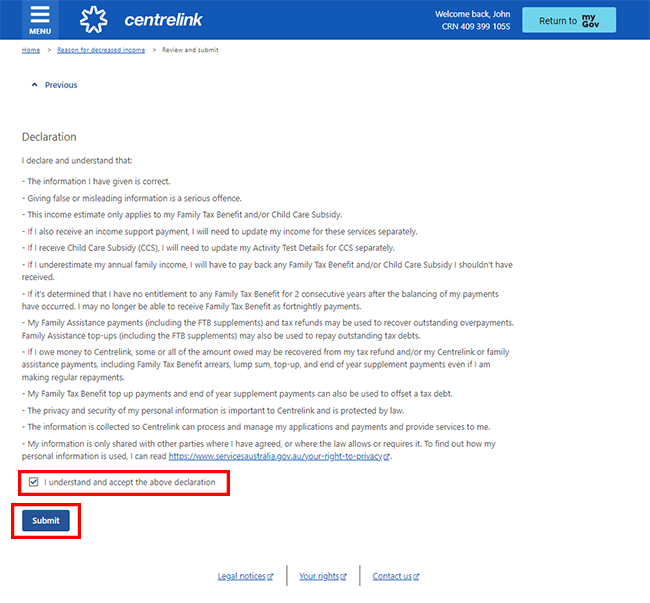

If all the details are correct, read the declaration. If you understand and agree with the declaration, select I understand and accept the above declaration. Then select Submit.

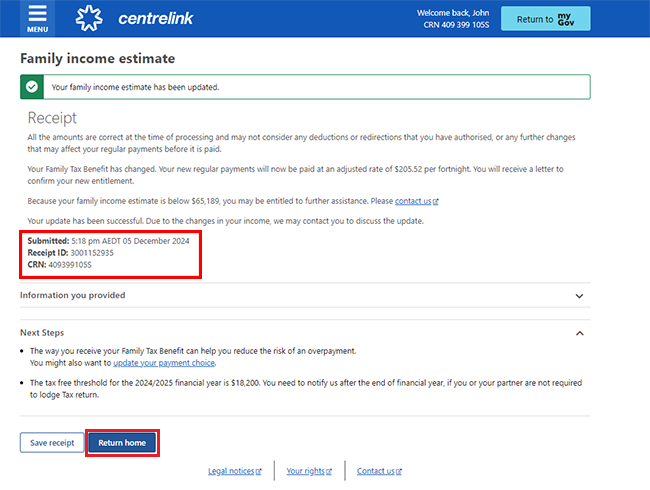

We’ll give you a Receipt ID when you submit your update. Make a note of this number for your records.

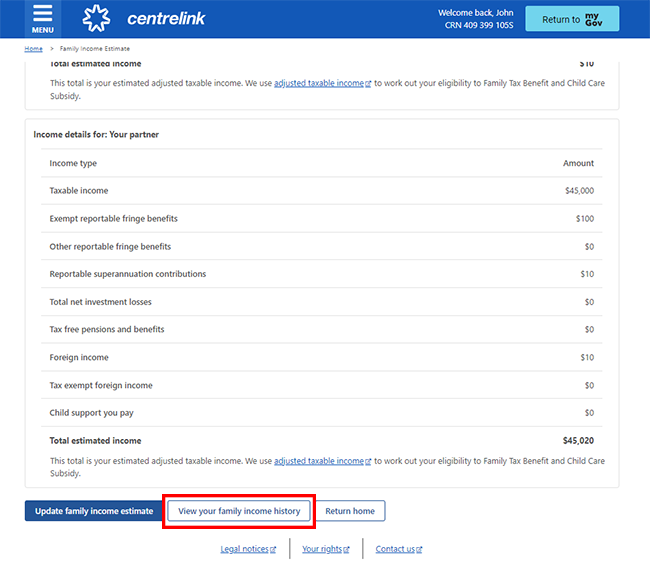

Step 4: view your family income history

You can view your family income history.

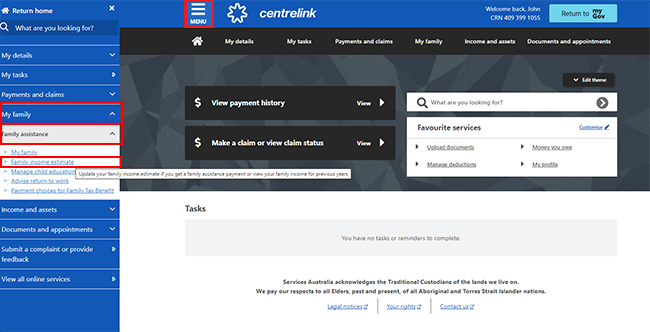

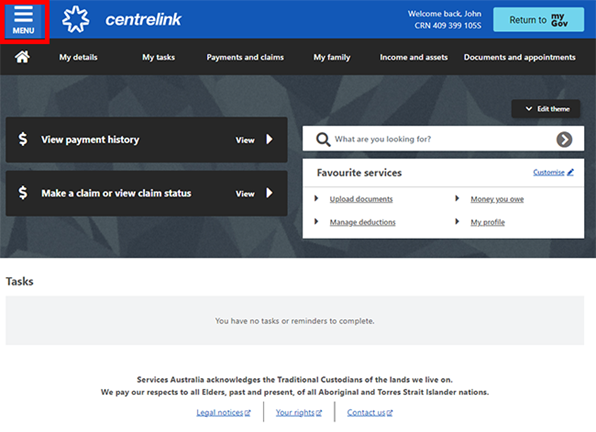

Select MENU from your homepage.

Select My family, then Family income estimate.

Move down the page and select View your family income history.

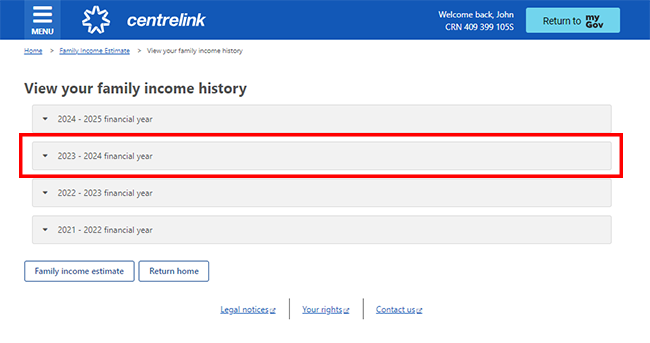

Select the financial year of your family income history you’d like to view.

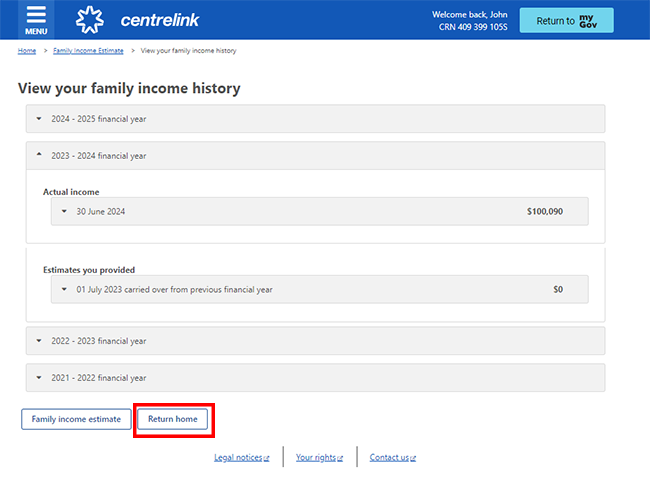

You can view a list of the past estimates you provided and the income we’ve used, if your payments have been balanced. When you’ve finished, select Return home.

Step 5: next steps

When you update your income estimate, you should also consider if anything else has changed. If you get Child Care Subsidy, you may also need to update your activity level.

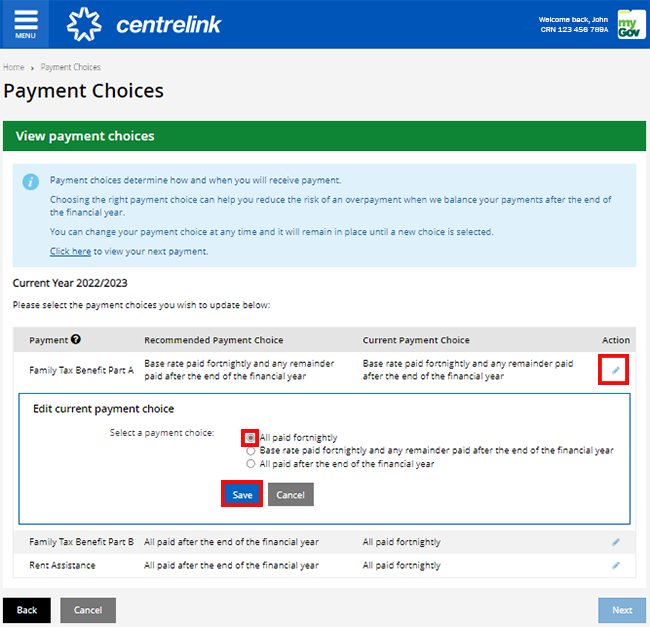

For Family Tax Benefit, you can also update your payment choice. To help avoid an overpayment, we’ll recommend a payment choice for you based on your circumstances.

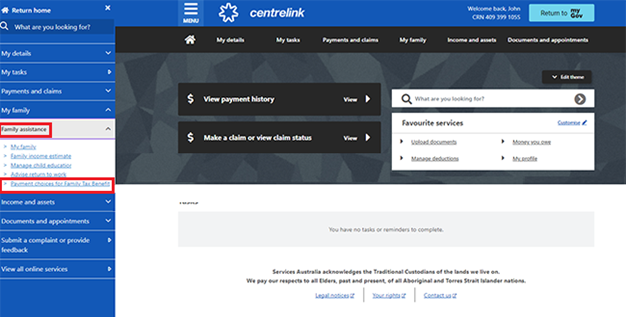

To update your payment choice for Family Tax Benefit, select MENU from your homepage.

Select My family, then Family assistance and Payment choices for Family Tax Benefit.

Select the pencil icon next to the payment you want to update. Select your new payment choice, then Save.

Then select Next.

Read more about payment choices for Family Tax Benefit.

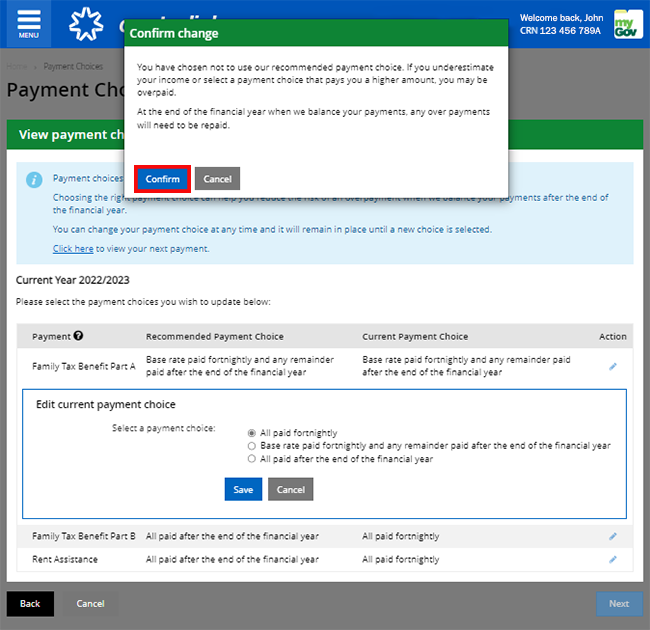

Step 6: confirm update to payment choices

Confirm your changes. We may overpay you if you choose not to use our recommended payment choice. If you’re paid too much, you’ll have to pay any excess amount back. We’ll let you know if this happens.

Read the information and select Confirm to update your payment choice.

Review the payment choice you’ve updated, then select Next.

If all the details are correct, read the declaration. If you understand and accept the declaration, select I declare that, then Submit.

We’ll give you a Receipt ID when you submit your update. Make a note of this number for your records.

Select Finish to go back to your homepage.

If you get Child Care Subsidy, you may need to update your activity test. Read more about how to update your activity test.

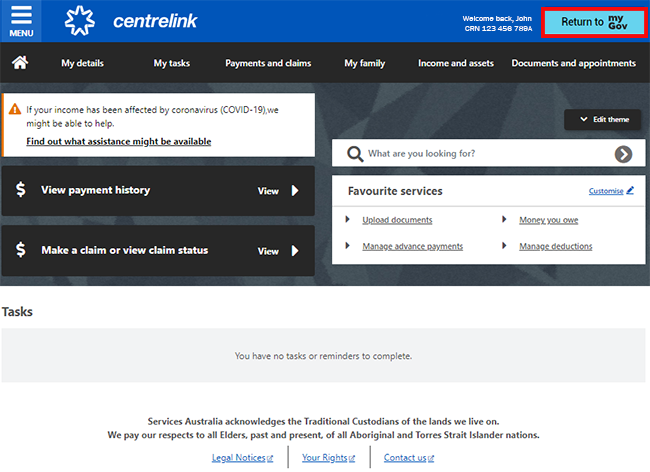

Step 7: sign out

From your homepage, you can complete other transactions or select Return to myGov to go back to your myGov account.

For your privacy and security, sign out when you’ve finished using your myGov account.

View other online account and Express Plus mobile app guides and video demonstrations about using your online account.