in this guide

If you have a Centrelink debt or overpayment, we want to help you repay it in a way that best suits your situation. You can pay back the money you owe by any of these methods:

- credit or debit card

- Post Billpay

- BPAY.

If you’re paying by BPAY, make sure you have your BPAY reference number.

Keep in mind we don’t accept cash, cheques or money orders.

If you’ve been impacted by a disaster or hardship event, you may be able to pause or change your debt repayments. Read more about the flexible choices available for when you need to pause your debt repayments.

The screenshots in this guide are from an iOS device. Some screens may look different if you’re using an Android device.

Watch our video for instructions on repaying the money you owe.

Step 1: get started

There are 2 ways to access this service:

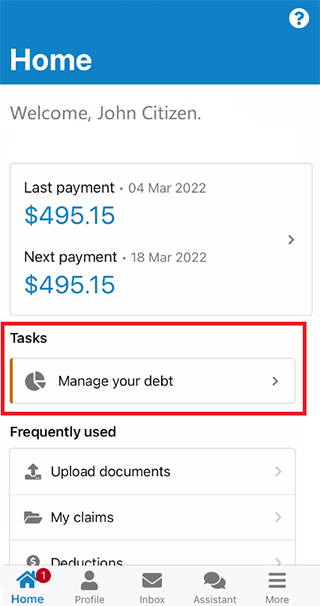

Using Tasks

We’ll send you a task if you need to update your debt details. From your home screen, select it in Tasks.

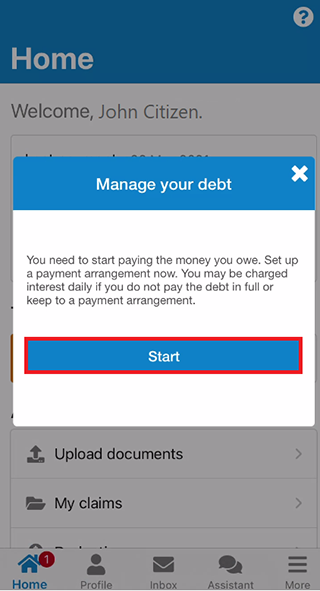

Read what you need to do, then select Start.

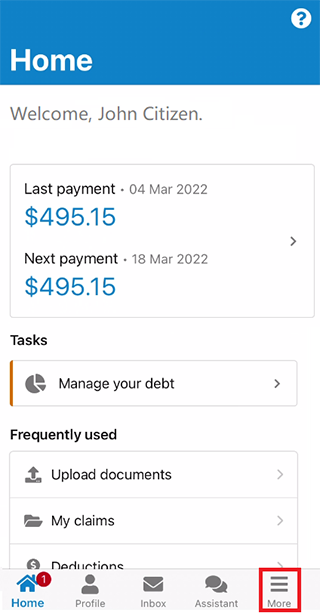

Using More menu

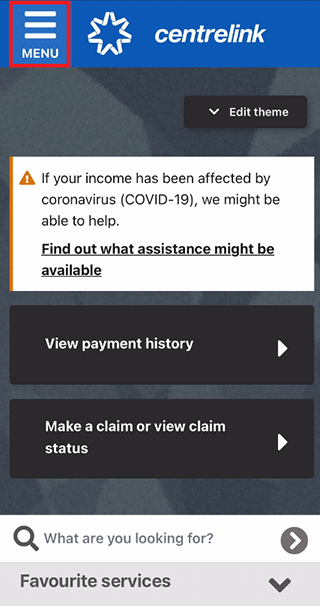

Select More from your home screen.

Select Money you owe.

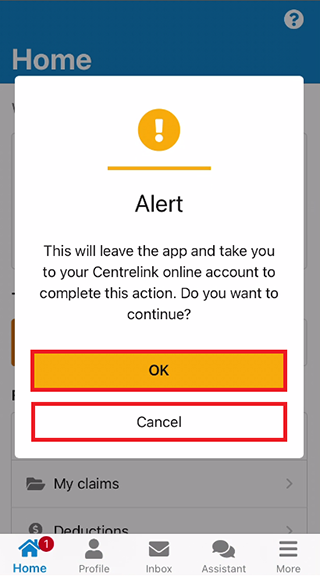

Select OK to leave the app and securely go to your Centrelink online account on your mobile internet browser.

Select Cancel if you don’t want to continue.

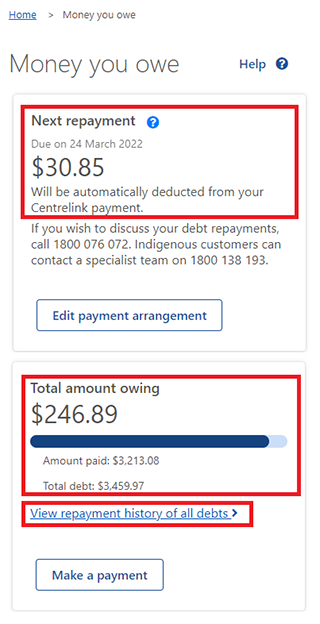

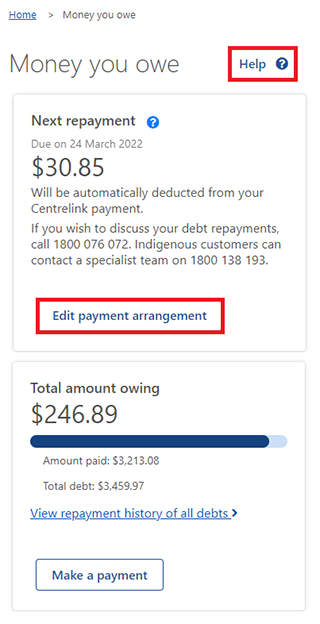

The Money you owe screen shows all of the following:

- your Next repayment amount, if you have a payment arrangement set up

- your next repayment due date

- the Total debt and amount owing on each debt

- the Amount paid in total and on each debt

- a View repayment history of all debts option you can select to view payments you’ve made.

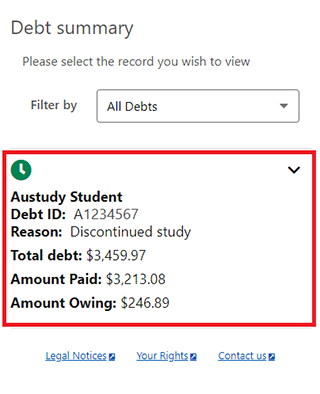

Move down the screen to view current and previous debts you’ve repaid, including:

- the payment you were getting when you got the debt

- the Debt ID number

- the reason for the debt

- the total debt

- amount paid

- amount owing

- any interest included.

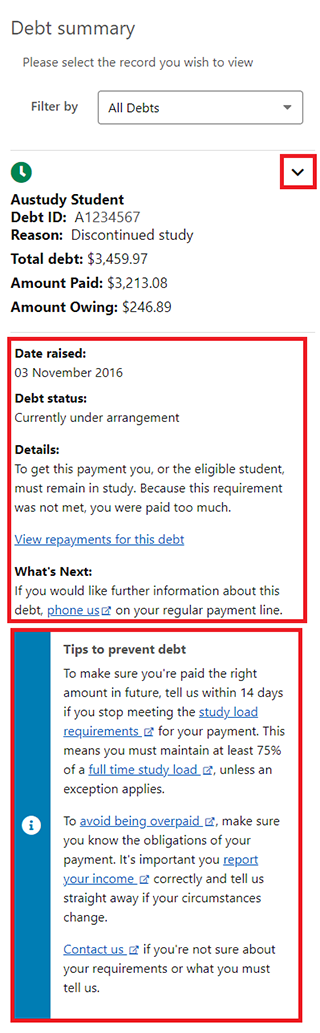

Select the arrow icon to view more details about your debt, including:

- the date you got the debt

- the status of the debt

- more information about the reason for the debt.

Tips to prevent debt or resolve your debt will show for some debt reasons.

Next, you can select any of the following. If you want to:

- make a payment, go to step 2

- edit your payment arrangement, go to step 3

- set up a new payment arrangement, go to step 4.

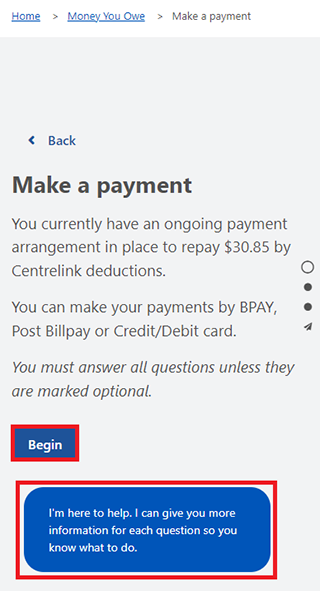

Step 2: make a payment

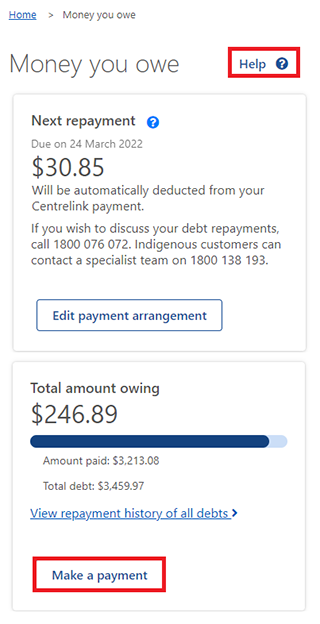

Select Make a payment.

If you need help, select Help.

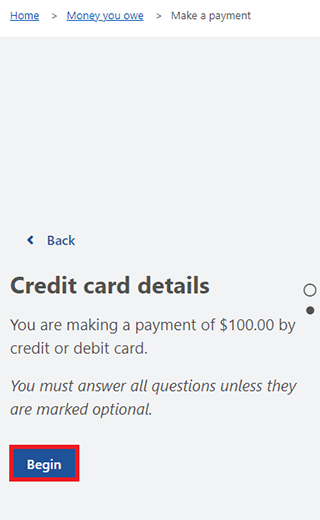

Select Begin to make a payment.

If you need help, read the information on each screen.

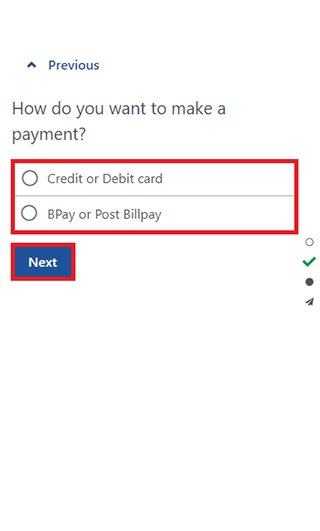

Under How do you want to make a payment, you can select either:

- Credit or Debit card

- BPAY or Post Billpay.

Then select Next.

If you select Credit or Debit card, make sure you have your card with you.

If you select BPAY or Post Billpay, we’ll give you the details to make a payment. Use these details to make a payment directly from your Australian bank account or at any Australia Post agent.

In this example, we’ll select Credit or Debit card.

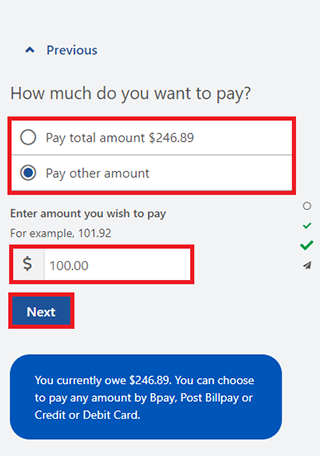

Select either:

- Pay total amount to pay the total debt amount

- Pay other amount to make a part payment.

When you select Pay other amount to make a part payment, you need to tell us how much you’re paying. Enter the amount you want to pay using Australian dollars, cents and a decimal point.

Then select Next.

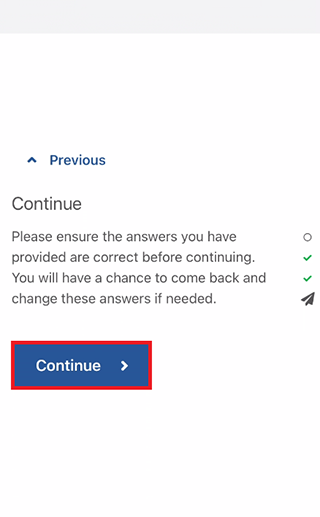

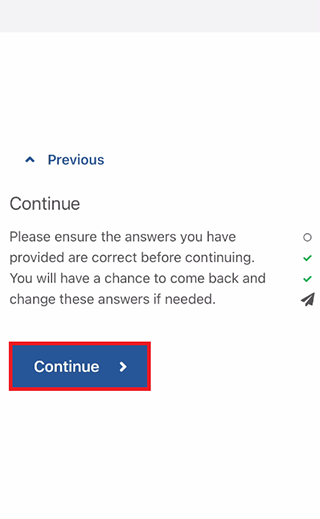

Select Continue to proceed.

Select Begin to give us your credit or debit card details.

If you’re going to pay by BPAY or Post Billpay, we’ll give you a barcode or reference details. You can use these details to make your payment.

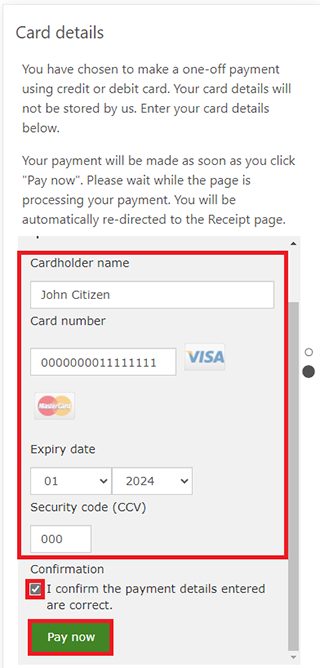

On the Card details screen, enter all of your card details. You need to include all of the following:

- Cardholder name

- Card number

- Expiry date on the card, month and year

- Security code (CCV), the 3 digit number on the back of the card.

If the details you’ve entered are correct, select I confirm the payment details entered are correct, then Pay now.

If the details are wrong, enter them again to change.

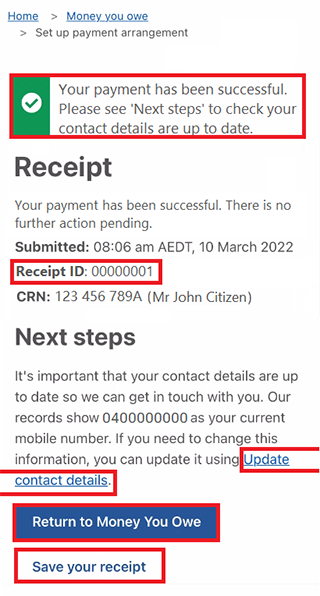

Get your receipt

We’ll give you a receipt when you make a payment. Make a note of the Receipt ID for your records.

On this screen, you can select any of the following:

- Update contact details to change your contact information

- Return to Money You Owe to go back to the Money you owe screen

- Save your receipt to keep a copy of your receipt.

This is the end of how to make a payment.

Next, you can select any of the following. If you want to:

- edit your payment arrangement, go to step 3

- set up a new payment arrangement, go to step 4

- sign out, go to step 5.

Step 3: edit your payment arrangement

You can use this service to both:

You won’t be able to use this service if either:

- you have more than one payment arrangement in place

- the balance of your debt is less than 5 cents.

To discuss your repayments, phone us on either the:

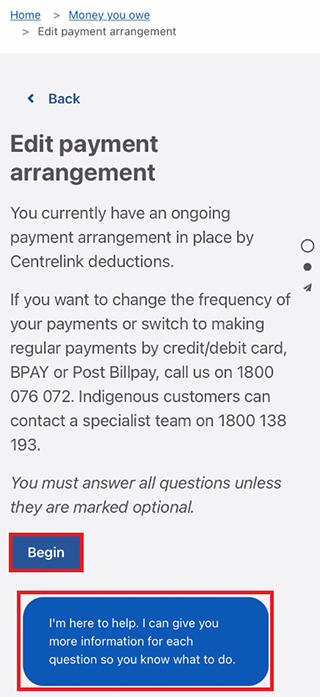

On the Money you owe screen, select Edit payment arrangement.

If you need help, select Help.

Change the amount you currently pay

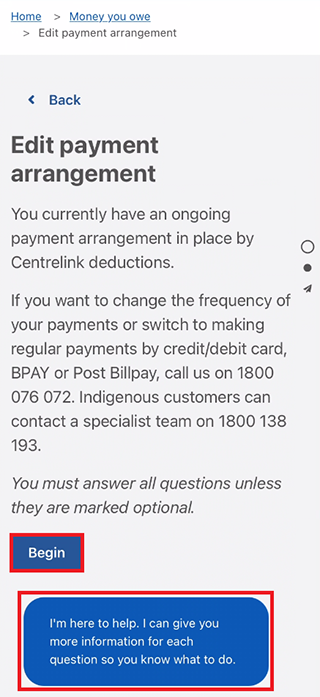

Select Begin to edit your payment arrangement.

If you need help, read the information on each screen.

Tell us how you want us to deduct the money

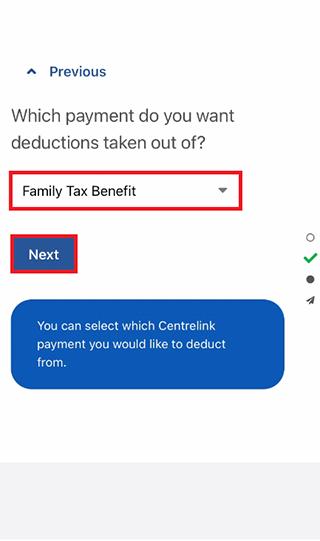

You can only deduct money from payments you get from us. You may get more than one payment from us. If so, you’ll need to choose which payment to use to repay your debt.

If you only get one payment from us, you won’t see this screen.

You’ll need to select how you want to repay, then Next.

In this example, we’ll select the Family Tax Benefit payment to repay the debt.

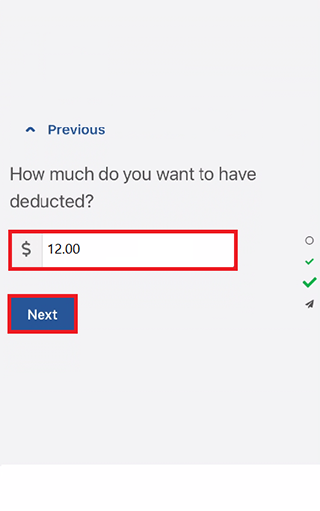

Enter how much you want to have deducted. This is the amount you’ll pay back each fortnight. Enter the amount using Australian dollars, cents and a decimal point. Then select Next.

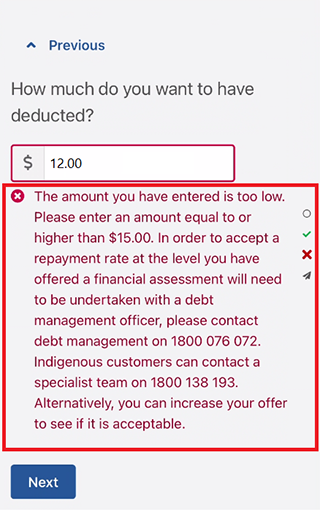

A warning will show if we don’t accept the amount you put in and you need to enter a higher amount. If you can’t make a higher repayment, phone us on the Debt recovery line to work out an amount you can pay.

When we accept the amount you put in, select Continue and go to Review and Submit.

Change your direct debit account details

You can change where we deduct your payment from if both of these apply:

- you repay your debt by direct debit

- your next payment isn’t due within 5 business days.

Select Begin to edit your details.

If you need help, read the information on each screen.

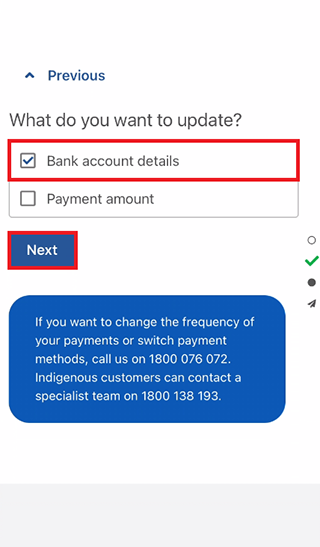

Select Bank account details, then Next.

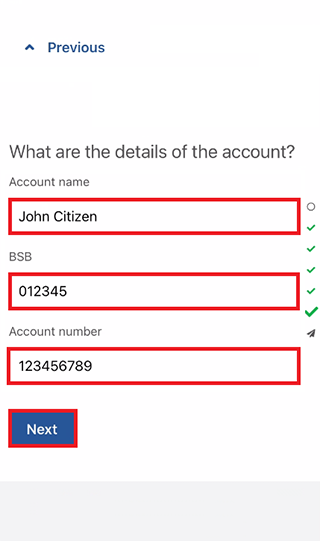

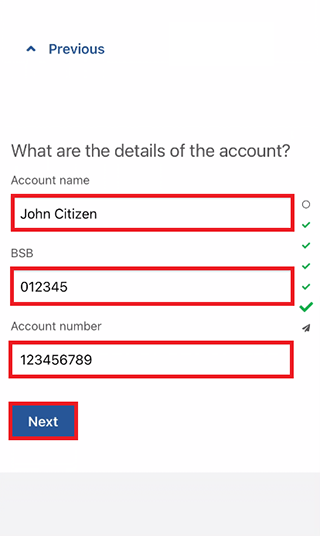

Enter your Australian account details including your:

- Account name

- BSB

- Account number.

Then select Next.

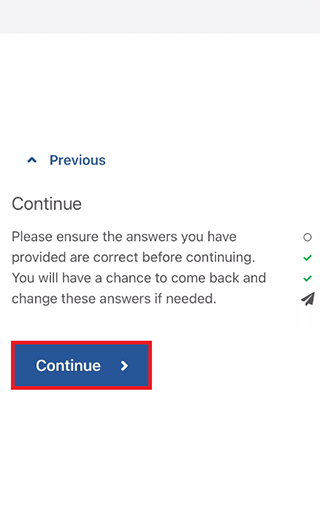

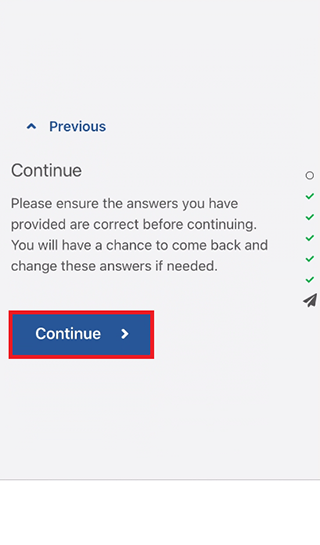

Select Continue to proceed.

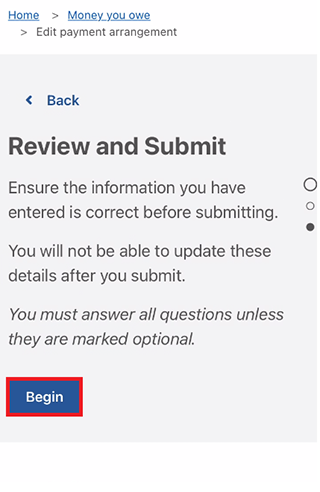

Review and Submit

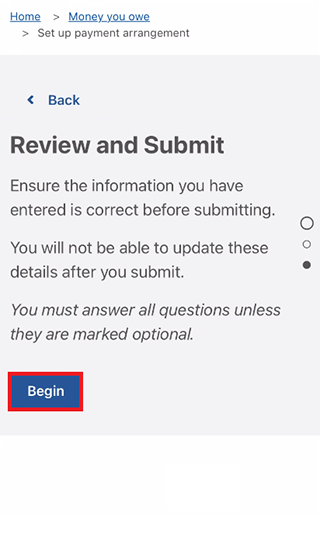

Select Begin to review and submit the edit to your payment arrangement details.

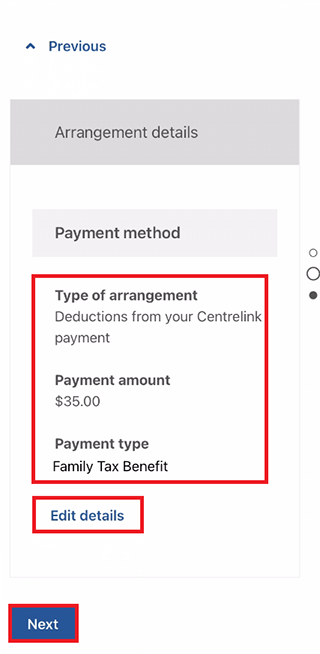

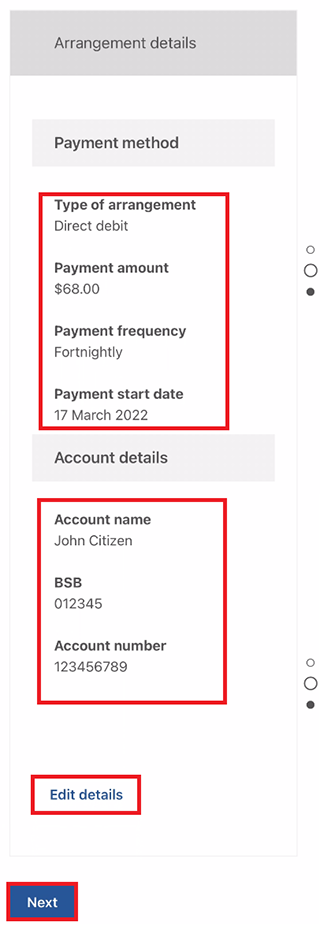

The payment arrangement details you changed will show, including all of the following:

- Type of arrangement

- Account details

- Payment amount

- Benefit type.

Make sure the details are correct.

Select either:

- Edit details to make changes if the details are wrong

- Next if the details are correct.

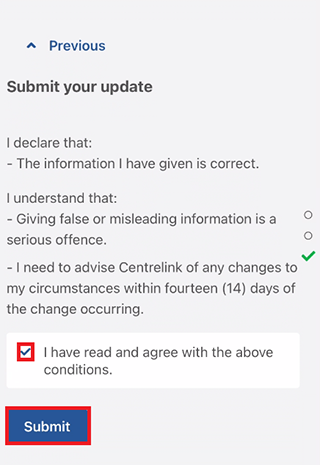

Read the declaration. If you understand and agree with the declaration, select I have read and agree with the above conditions, then Submit.

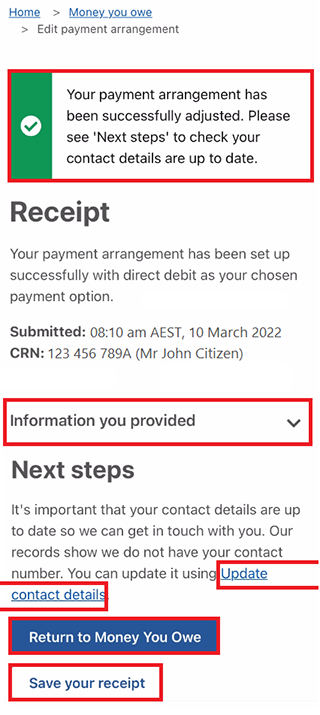

Get your receipt

We’ll tell you if your payment arrangement has been successfully adjusted. We’ll give you a receipt to confirm the changes to your payment arrangement.

On this screen, you can select any of the following:

- Information you provided to view a summary of your changes

- Update contact details to change your contact information

- Return to Money You Owe to go back to the Money you owe screen

- Save your receipt to keep a copy of your receipt.

This is the end of how to update your payment arrangement.

Next, you can select any of the following. If you want to:

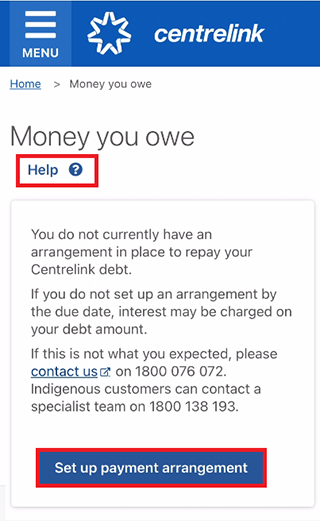

Step 4: set up a new payment arrangement

You won’t be able to use this service if either:

- you already have a payment arrangement set up

- the balance of your debt is less than 5 cents.

You’ll need to contact us on one of the following phone lines to discuss your repayments:

On the Money you owe screen, select Set up payment arrangement.

If you need help, select Help.

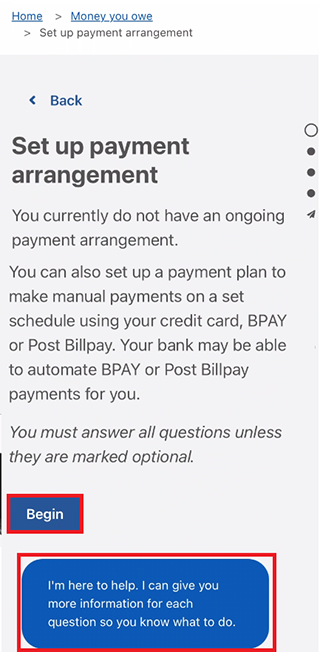

Select Begin to set up a payment arrangement.

If you need help, read the information on each screen.

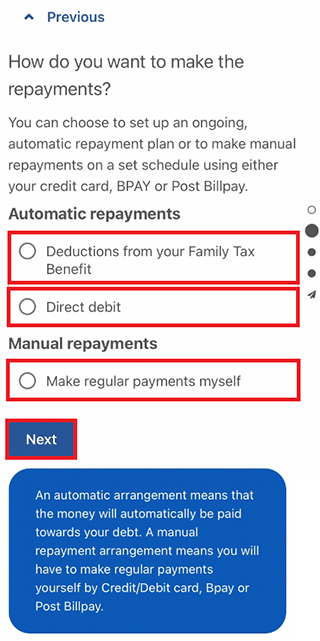

Choose how you want to make your repayments.

Select one of the following options:

- Deductions from your payment type if you get a current payment and want money taken from it automatically before you’re paid

- Direct debit to have regular automatic payments taken out of your bank account

- Make regular payments myself to arrange manual payments with a credit or debit card, BPAY or Post Billpay. These can be weekly, fortnightly or monthly.

Then select Next.

In this example, we’ll select the automatic repayments option of Direct debit.

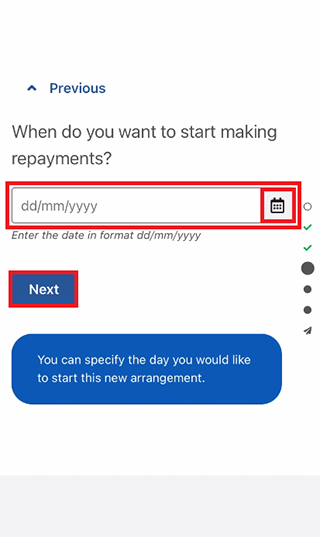

Select the calendar icon and enter the date you want to start making repayments. You’ll need to include the day, month and year. Then select Next.

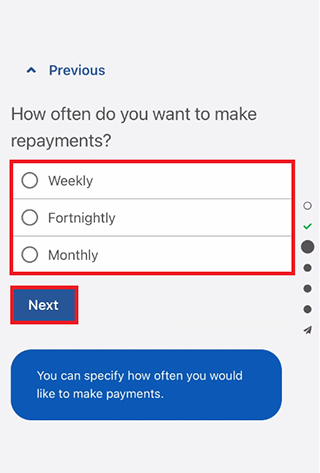

Choose how often you want to make repayments. You can select one of the following:

- Weekly

- Fortnightly

- Monthly.

Then select Next.

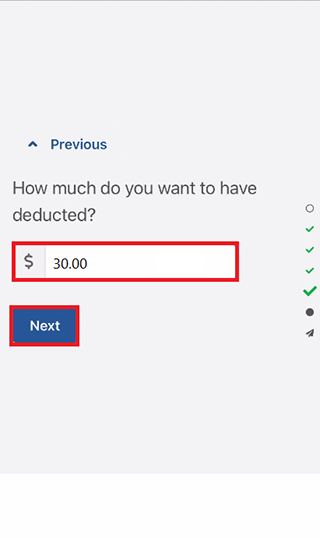

Enter the amount you want to have deducted. This is the amount you’ll repay each week, fortnight or month. Enter the amount using Australian dollars, cents and a decimal point. Then select Next.

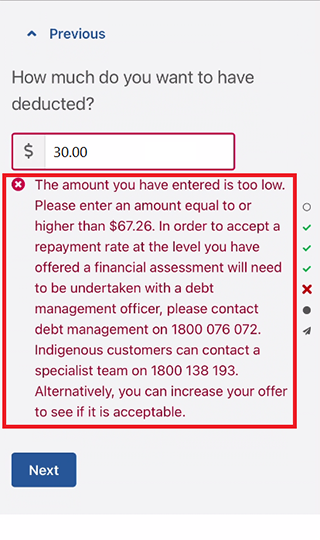

A warning will show if we don’t accept the amount you put in and you need to enter a higher amount. If you can’t make a higher repayment, phone us on the Debt recovery line to work out an amount you can pay.

Depending on what you chose to make your repayments, we’ll either:

- ask you for your Australian bank account details

- give you the reference details to pay by BPAY or Post Billpay.

If you chose to arrange a direct debit from your bank account, enter your Australian account details including your:

- Account name

- BSB

- Account number.

Make sure your details are correct, then select Next.

Select Continue to proceed.

Review and Submit

Select Begin to review and submit your new payment arrangement.

We’ll give you a summary of the details you’ve given us. Make sure your details are correct.

Select either:

- Edit details to make changes if the details are wrong

- Next if the details are correct.

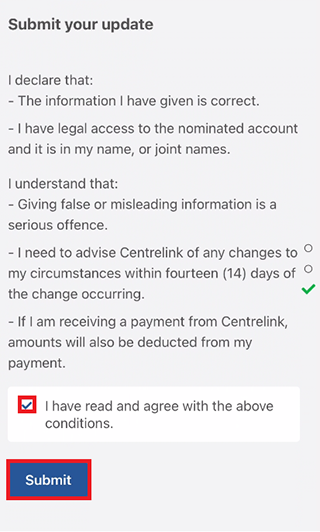

Read the declaration. If you understand and agree with the declaration, select I have read and agree with the above conditions, then Submit.

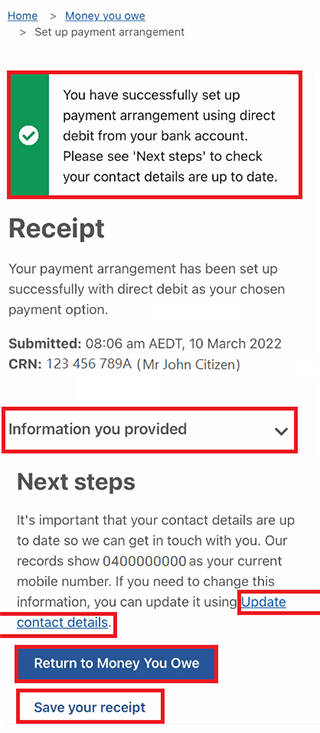

Get your receipt

We’ll tell you if your payment set up has been successful. We’ll give you a receipt to confirm the changes to your new payment arrangement.

On this screen, you can select any of the following:

- Information you provided to view your new repayment amount details

- Update contact details to change your contact information

- Return to Money You Owe to go back to the Money you owe screen

- Save your receipt to keep a copy of your receipt.

This is the end of how to set up a new payment arrangement.

Next, you can select any of the following. If you want to:

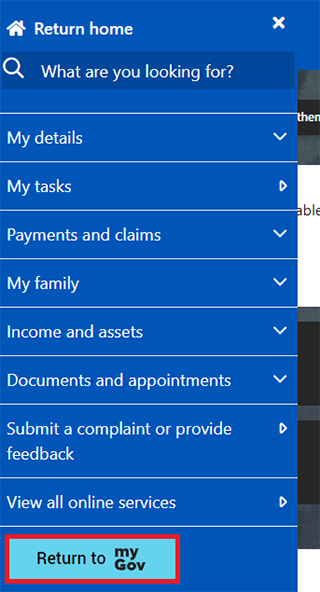

Step 5: sign out

To sign out, select MENU on your home screen, then Return to myGov.

For your privacy and security, sign out when you’ve finished using your myGov account.

View other online account and Express Plus Centrelink mobile app guides and video demonstrations about using your online account.

Contact numbers available on this page.

Centrelink debt recovery line

Use this line to discuss repaying an existing Centrelink debt.

Centrelink Indigenous debt recovery line

Use this line if you’re an Aboriginal or Torres Strait Islander Australian and need help repaying a Centrelink debt.

There are other ways you may want to contact us.